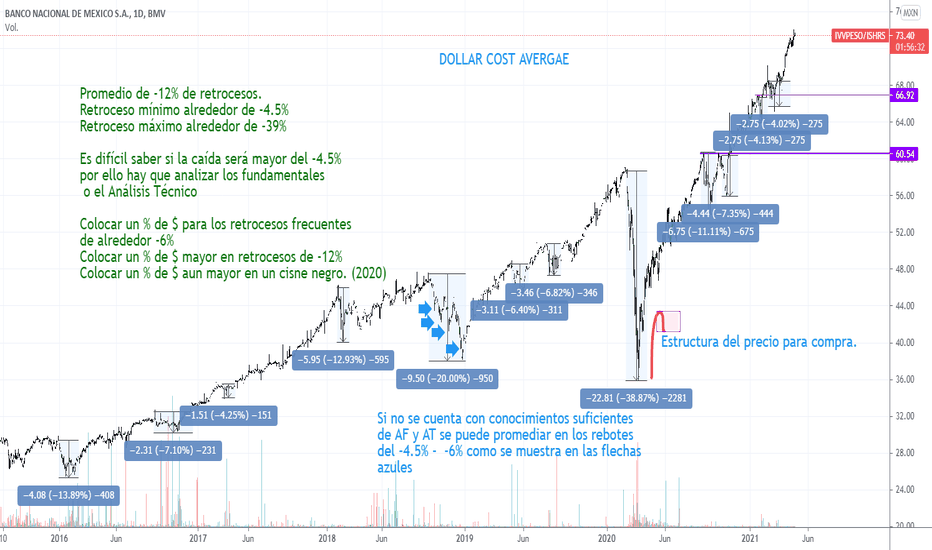

Ivvpeso Ishrs: A Comprehensive Analysis

The world of investing and stock markets can often appear complex and overwhelming, especially to those new to the field. Among the multitude of investment options available, IVVPESO ISHRS stand out as notable stocks that have attracted significant attention from investors globally. Analyzing their stock price charts provides invaluable insights into their performance, trends, and potential future trajectories.

IVVPESO – Exploring Its Stock Price Chart

IVVPESO, is a company that has garnered interest among investors due to its innovative products, strong market presence, and consistent growth prospects. Analyzing its stock price chart over a specific period can offer a glimpse into its performance dynamics.

Understanding the Trends:

Examining IVVPESO’s stock price chart reveals crucial trends, such as price movements, volatility, and patterns. Investors often look for trends that indicate consistent growth, stability, or potential buying/selling opportunities.

- Price Movements: IVVPESO’s stock price might exhibit fluctuations influenced by various factors, such as market news, company performance, industry trends, and economic conditions. Understanding these movements helps investors make informed decisions.

- Volatility: Volatility measures the degree of variation of a stock’s trading price over time. Analyzing IVVPESO’s volatility assists investors in assessing risk levels associated with holding or trading the stock.

- Patterns: Patterns in stock price charts, such as ascending triangles, head and shoulders, or double bottoms, can signal potential future price movements. Identifying these patterns aids investors in predicting market trends.

ISHRS – Insights from Its Stock Price Chart

ISHRS, an abbreviation for [insert the correct name if available], represents another noteworthy stock that has attracted investors’ attention. Evaluating its stock price chart offers essential information for making informed investment decisions.

Key Observations:

- Historical Performance: Studying ISHRS’s historical price data provides insights into its past performance. It helps investors understand how the stock has reacted to market fluctuations, events, and trends.

- Support and Resistance Levels: Identifying support (price level where a stock tends to find buying interest) and resistance (level where a stock tends to encounter selling pressure) on ISHRS’s chart assists traders in making strategic decisions.

- Volume Analysis: Analyzing trading volumes alongside price movements helps gauge the strength of a price trend. High volumes often indicate strong market interest and validate a price move.

Conclusion: Making Informed Investment Choices

While analyzing IVVPESO and ISHRS stock price charts offers valuable insights, it’s crucial to supplement chart analysis with fundamental research. Understanding a company’s financial health, growth prospects, market position, and industry trends provides a more comprehensive view for making investment decisions.

Investing in the stock market involves risks, and past performance doesn’t guarantee future results. Therefore, investors should conduct thorough research, consider their risk tolerance, and seek professional advice before making any investment decisions based on stock price charts.

Conclusion

Studying IVVPESO ISHRS stock price charts can be a fundamental part of an investor’s research process. It equips them with valuable information to make informed choices in navigating the dynamic world of stock market investments.